This, in turn, could benefit a company's working capital management, reducing its financial costs. It could also mean the company has negotiated different terms with its suppliers - such as low-interest rates or longer payment periods. However, a decreasing accounts payable turnover ratio is not always bad. It means the company has less cash than earlier assessment and might be distressed financially. Decreasing accounts payable turnover ratioĪ decreasing AP turnover ratio signals the company is taking longer than usual to pay off its debt obligations. This could signal a lower growth rate in the long term. However, if the ratio increases continuously, it could mean the firm is not reinvesting revenues. This could indicate that the company is effectively managing its cash flow. It means the firm has more cash than earlier - meaning its ability to pay off its creditors has increased. Increasing accounts payable turnover ratioĪn increasing AP turnover ratio suggests the company is paying off its suppliers faster than it did in the previous accounting period. Let’s see what an increasing or decreasing turnover ratio can suggest to investors. But not so quickly that it misses growth opportunities. Ideally, a company should generate enough revenue to meet its short-term debt obligations.

Investors typically compare an accounting period’s AP turnover ratio with other accounting periods to make a decision. The accounts payable turnover ratio can increase or decrease compared to previous years. Stakeholders and investors use this ratio to determine whether the company has enough revenue to meet its short-term debt obligations, showing them the firm’s financial conditions and helping them decide whether or not to extend a credit line. One way to effectively measure AP turnover ratio is by comparing one firm’s ratio by another in the same industry.

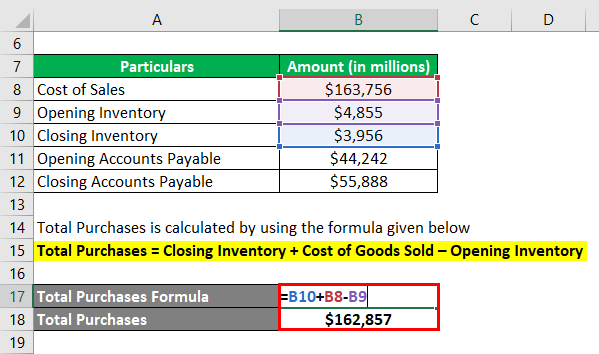

The accounts payable turnover ratio measures the speed at which the firm pays off its creditors and suppliers during an accounting period. Interpretation of Accounts Payable Turnover Ratio Therefore, ABC’s accounts payable turned over approximately 2.7 times during the fiscal year. Therefore, as per the accounts payable turnover formula:Īccounts payable turnover ratio = 190 million / 70 million = 2.71

The accounts payable turnover ratio is calculated by dividing the company’s total purchases in a period by the average payables for that period. What is the formula for the accounts payable turnover ratio? And the accounts payable turnover ratio shows how often a company pays off its creditors in a certain period.

Payables are the amount a firm owes to its creditors and suppliers for the purchases made. The accounts payable turnover ratio is a short-term liquidity measure which quantifies the rate at which a firm pays off its payables. What is the Accounts Payable Turnover Ratio? Accounts payable are short-term debts for the firm for purchase of goods on credit basis, listed on the balance sheet under current liabilities.Ĭontinue reading to find out its meaning, formula, and interpretation with examples. It is also known as creditor’s turnover or payables turnover. Accounts payable (AP) turnover ratio is a liquidity ratio used to measure how quickly a company pays its bills to creditors in a certain period.

0 kommentar(er)

0 kommentar(er)